DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a. Asset turnover sales turnover net.

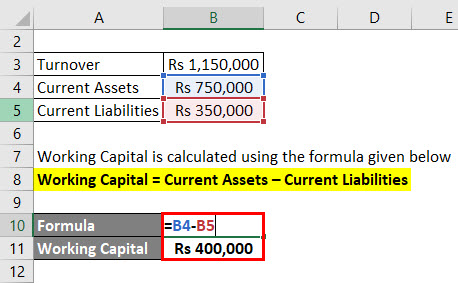

What Is Net Working Capital How To Calculate Nwc Formula

One final ratio that relates to working capital is the working capital.

. Gearing Long term loans Capital employed x 100. This puts pressure on its working capital the excess of current assets over current liabilities. Working capital current ratio current assets CAcurrent liabilities CL.

The ideal inventory to working capital ratio is 11. The compression ratio of an engine is a very important element in engine performance. It is very tempting to draw definite conclusionsfrom limited information or to say that the current ratio should be 2or that the quick ratio should be 1.

Conventional wisdom has it that an ideal current ratio is 2 and anideal quick ratio is 1. 11 seen as ideal. Although this system is inexpensive it isnt the most ideal inventory system because there are extended lag times in real data.

If this ratio exceeds between 21 and 31 then the company has an opportunity for improvement by increasing its turnover rate in order to achieve a leaner operation with less stocked inventories. The compression ratio is the ratio between two elements. The gas volume in the cylinder with the piston at its highest point top dead center of the stroke TDC and the gas volume with the piston at its lowest point bottom dead center of the stroke BDC.

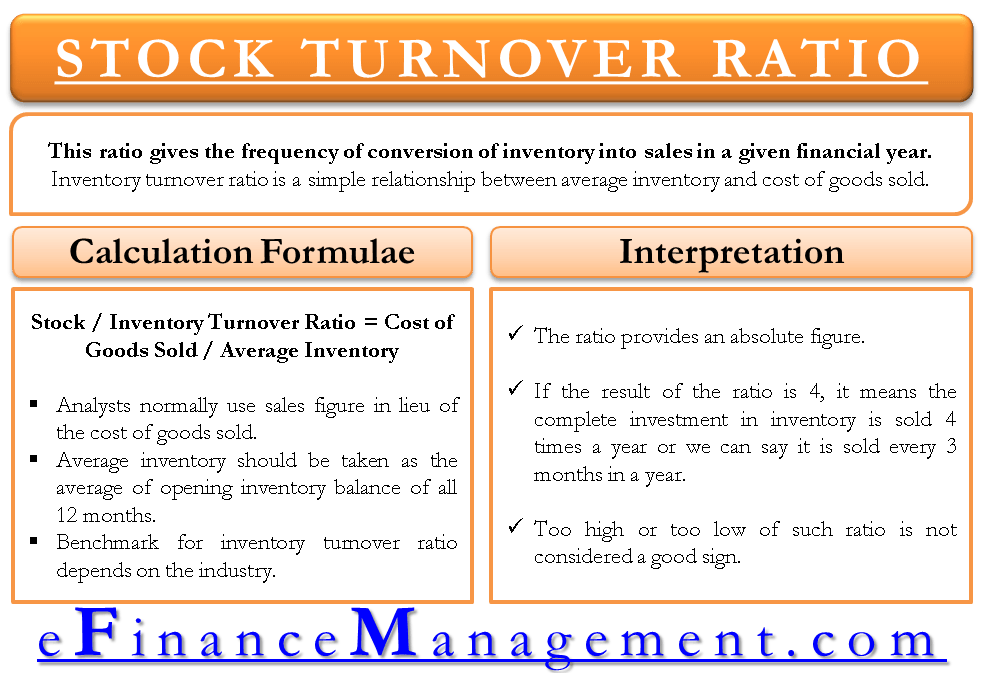

A STUDY ON FINANCIAL PERFORMANCE USING RATIO ANALYSIS AT ING VYSYA BANK PROJECT REPORT Submitted To UNIVERSITY OF MADRAS In partial fulfillment of the requirement for the award of MASTER OF COMMERCE SUBMITTED BY NSABARISUDHA KC10557 UNDER THE GUIDANCE OF Mrs. Stock turnover ratio cost of sales stock. Liquidity or Short-Term Solvency ratios Short-term funds management Working capital management is important as it signals the firms ability to meet short term debt obligations.

Current ratio The ideal benchmark for the current ratio is 21 where there are two dollars of current assets CA to cover 1 of current. If Shane only takes an inventory count every three months he might not see problems with the inventory or catch shrinkage as it happens over time. This means that it takes 1 dollar of inventory to generate 1 dollar of working capital.

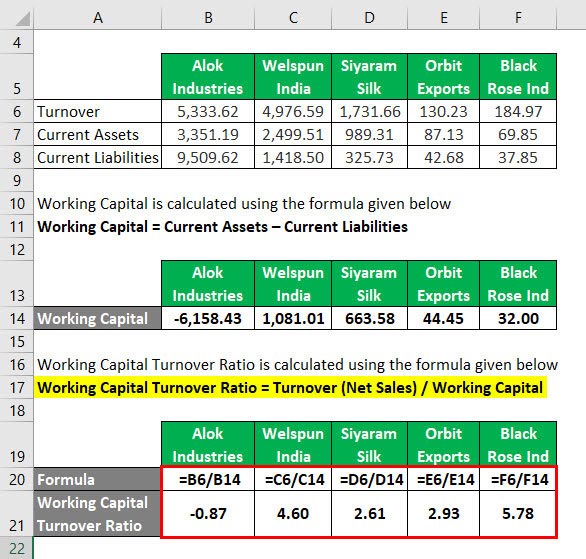

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratios Universal Cpa Review

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Cycle Efinancemanagement

Stock Inventory Turnover Ratio Calculate Formula Benchmark

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Ratio Analysis Example Of Working Capital Ratio

Working Capital Turnover Ratio College Adventures Interpretation Ratio

Working Capital Turnover Efinancemanagement Com

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

Working Capital Turnover Ratio Meaning Formula Calculation

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Analyze Improve Asset Turnover Ratio Efinancemanagement